In 2010, a motor vehicle theft occurred every 42.8 seconds in the United States.1

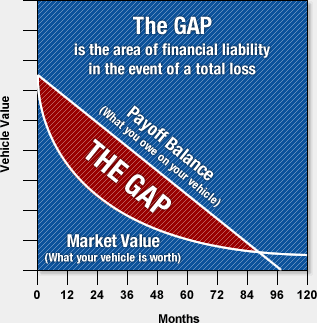

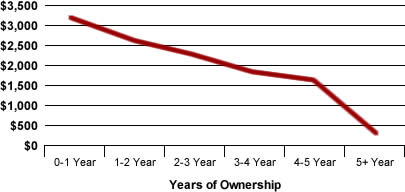

In the event of total loss, the difference between what you owe on your vehicle

loan and the amount you receive from your primary insurance carrier is greater in

the early years of vehicle ownership.

Cost above are for illustrative purposes only.

Actual costs may vary as to make, model and year.

What Guaranteed Asset Protection (GAP) Pays

In the unfortunate event your vehicle is declared a total loss due to an unrecoverable

theft or accidental damage, your auto insurance company will typically pay the current

market value of your vehicle less your deductible. But what if your loan or lease

balance is higher than the market value of your vehicle? Answer: You would be responsible

for paying off the difference, including your deductible. This can be expensive.

The reason for the potential difference is that normally the loan/lease balance

decreases at a predictable amount as monthly payments are made. However, the market

value of your vehicle is influenced by several variable factors (e.g. supply, demand,

mileage). This means that market value often may be lower than your outstanding

balance – particularly early in your contract when you have the most to lose.

GAP can help waive the difference, including up to

$1,000 of your insurance deductible.2

The Choice is Yours

GAP is an optional form of protection available only at the time you sign your Retail

Finance or Lease Contract with the dealership. If you would like to know more about

GAP, ask to see the GAP contract. Besides the limitations listed at the right,

terms and conditions may vary by state.

GAP is an optional form of protection available only at the time you sign your Retail

Finance or Lease Contract with the dealership. If you would like to know more about

GAP, ask to see the GAP contract. Besides the limitations listed at the right,

terms and conditions may vary by state.

Payment of Deductible2

GAP only provides a benefit if there is a balance due on the loan or lease after

the insurance settlement. If there is no balance due, we will not pay your deductible.

Refinance

GAP coverage is terminated if the Retail Finance or Lease Contract is refinanced.

Settlement Deductions

GAP waiver amount does not include insurance settlement deductions for customer retained

salvage, unrepaired physical damage, towing, rental or storage.

Non-Covered Finance Items

GAP waiver amount does not include late payments, deferred payments, late charges/interest

or interest after the date of loss.

Lost Equity

GAP does not refund advance payments or vehicle equity.

Uncancelled Add-Ons

GAP waiver amount does not include the refundable portion of any finance additions

such as credit insurance or service contracts.

Customer Secured Financing

GAP does not apply to any loan obtained from any finance source other than the dealer.

Insurance

GAP does not provide any insurance coverage for you or the vehicle, such as collision,

comprehensive, bodily injury, property damage or liability. You must have or obtain

physical damage insurance on your vehicle at the time of purchase in order for GAP

to be effective. GAP is not a replacement for primary auto insurance.

Guaranteed Asset Protection

Guaranteed Asset Protection

GAP is an optional form of protection available only at the time you sign your Retail

Finance or Lease Contract with the dealership. If you would like to know more about

GAP, ask to see the GAP contract. Besides the limitations listed at the right,

terms and conditions may vary by state.

GAP is an optional form of protection available only at the time you sign your Retail

Finance or Lease Contract with the dealership. If you would like to know more about

GAP, ask to see the GAP contract. Besides the limitations listed at the right,

terms and conditions may vary by state.